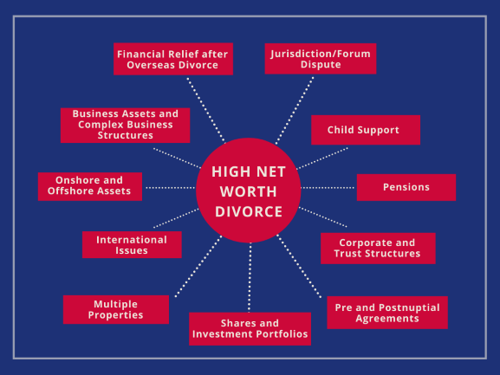

What makes a High Net Worth Divorce?

Any divorce has a huge emotional impact on the individuals involved, but for high net worth individuals it can also raise complex legal, financial and commercial issues. There are likely to be additional factors or challenges so we strongly advise that you seek legal advice at an early stage.

What is a High Net Worth Divorce?

A High Net Worth divorce may have the following characteristics:

Business Assets and Complex Business Structures

Valuing businesses and understanding complex business structures are vital as private limited companies are often the largest asset in a High Net Worth Divorce. We work holistically with forensic accountants to value business assets and to ensure we can provide you with the best possible advice. The valuation of a private company, interpreting complex remuneration schemes, finding hidden assets, and ensuring our clients understand the legal and commercial issues are central to our practice.

Corporate and Trust Structures

Trusts can be taken into account by the court when considering financial settlement on divorce and are capable of variation in favour of the parties or children. In England, a request can be made of the trustees to provide documents. If the trust is offshore this can be more difficult. If information regarding the trust is vague the court can make inferences about the nature and scale of the trust. Where there are potential beneficiaries to a discretionary trust, the court can request and encourage trustees to act in a certain way but they cannot force the trustees to make dispositions to the same beneficiary.

International Issues

We consider very early in a case with international issues, the appropriate forum to start divorce proceedings.

We assist couples who have properties and/or assets abroad. We consider how best to realise the asset, be it a property or pension, which can be so important to the overall settlement of a case. A pension company overseas may not accept an English Order. After an order is made in another country relating to a pension being shared, the pension provider in England may not recognise an overseas order. These are complex issues that require specialist advice.

Prenuptial and Postnuptial Agreements

We regularly deal with ringfencing assets by preparing pre and postnuptial agreements together with arguments regarding non-matrimonial assets. Whilst Prenuptial and Postnuptial agreements are not legally binding in England, an agreement can have significant weight with the court if drafted correctly and if it complies with certain legal principles which make it ultimately fair. Having these agreements reviewed often and whenever there is a big change is fundamental to the court having regard to it when determining the financial split.

Read more about Prenuptial and Postnuptial agreements by clicking on the links at the bottom of this article.

Non-Matrimonial Assets

In High Net Worth cases, there are often arguments regarding whether non-matrimonial assets should be shared between the spouses. Non-matrimonial assets are assets that have not built up during the marriage but were acquired before the marriage and/or following separation. Non-matrimonial assets are often assets brought into the marriage by one spouse, such as a family run business or private limited companies, family heirlooms, properties, and inheritance. Where the parties’ needs are easily met by the matrimonial assets, the court has the discretion to disregard such non-matrimonial assets, so the parties don’t share them.

Pensions

Pensions are complex creatures and after the family home are usually the second largest asset. Pensions are a wonderful tax efficient mechanism especially for those drawing high salaries. Often spouses are unaware of the lifetime allowance which may have been breached and fail to understand what this means for those millions in their pension pot. The lifetime allowance in 2021 currently stands at £1,073,100 and this is the limit on the amount of pension benefit that can be drawn from pension schemes, whether as lump sums or retirement income, without triggering an extra tax charge. If you have more than this in your pension pot when it crystalises you will be taxed and this can be as much as 55% depending on how you withdraw funds.

Other complexities around pensions can include the type of pension, whether it is in payment and a significant age difference between the spouses. We work closely with ‘Pensions on Divorce Experts’, often instructed by us to provide advice on how pensions should be split on divorce. We also have access to a ‘Shadow Expert’ who has contributed to the pension bible also known as the Guidance of the Treatment of Pensions on Divorce which is used by all the Family Court judges.

Child Support

In High Net Worth cases, the calculation of child maintenance is not as easy as going to the Child Maintenance Service (CMS) (previously known as the Child Support Agency CSA) and asking for a calculation or by using their online calculation and agreeing the amount between you. Often spouses earn more than £156k pa which is the maximum for a CMS calculation. Consideration must be given to all sources of income and where spouses earn over £156k pa the court has the power to make an order in addition to any financial provision required for private school fees.

Below is an example of a child maintenance situation:

- Husband earns £400k/£33,333pcm

- Husband has 2 children to his wife

- Husband also has a child to his new partner

How much maintenance should he pay?

- 11% is deducted for his child to his new partner - £3,666.93

The Husband will pay:

- 16% on the first £800 = £128

- 12% on the remaining £28,866.07= £3,463.93

The Husband's child maintenance liability is, therefore, £3,591.93pcm and not as per the CMS calculation of £1,525.88pcm.

Financial Relief after Overseas Divorce

We represent international clients who have divorced overseas and want to resolve the financial matters in England as it is a more favourable arena than where they divorced. As long as they satisfy the criteria for a Judge to make an order in England and Wales then they can ask the family court to deal with their financial claims. This usually involves an application to the court under Part III of the Matrimonial and Family Proceedings Act 1984 for a spouse to bring a financial claim after a foreign divorce.

How Neves Can Help

At Neves Solicitors, our divorce lawyers understand the many complex issues that can arise during high net worth divorces, some of which we have touched on above. Our experienced high net worth divorce lawyers specialise in all aspects of family law, including matrimonial finances, prenuptial agreements, international law and matters involving children.

If you are going through a divorce and would like further advice, then please contact our family law team. Book a fixed fee consultation with one of our family lawyers today. Call 0330 0945 500, email family@nevesllp.co.uk or complete our Contact Form and we'll get back to you.